About the study

BT asked Assembly for some economic modelling to illustrate the net benefits for digital migration (both fixed and mobile) for Critical National Infrastructure (CNI) customers, taking into account the costs of migration and the potential costs of inaction, particularly given rising fault rates on the PSTN.

For the first time, we've lifted the lid on legacy network migration and worked to understand the scope and scale of how key UK industries are still relying on aging fixed and mobile networks. Our research found that while the energy and water sectors are already well into their migrations, it’s vital that others follow to avoid growing costs and missed efficiencies.

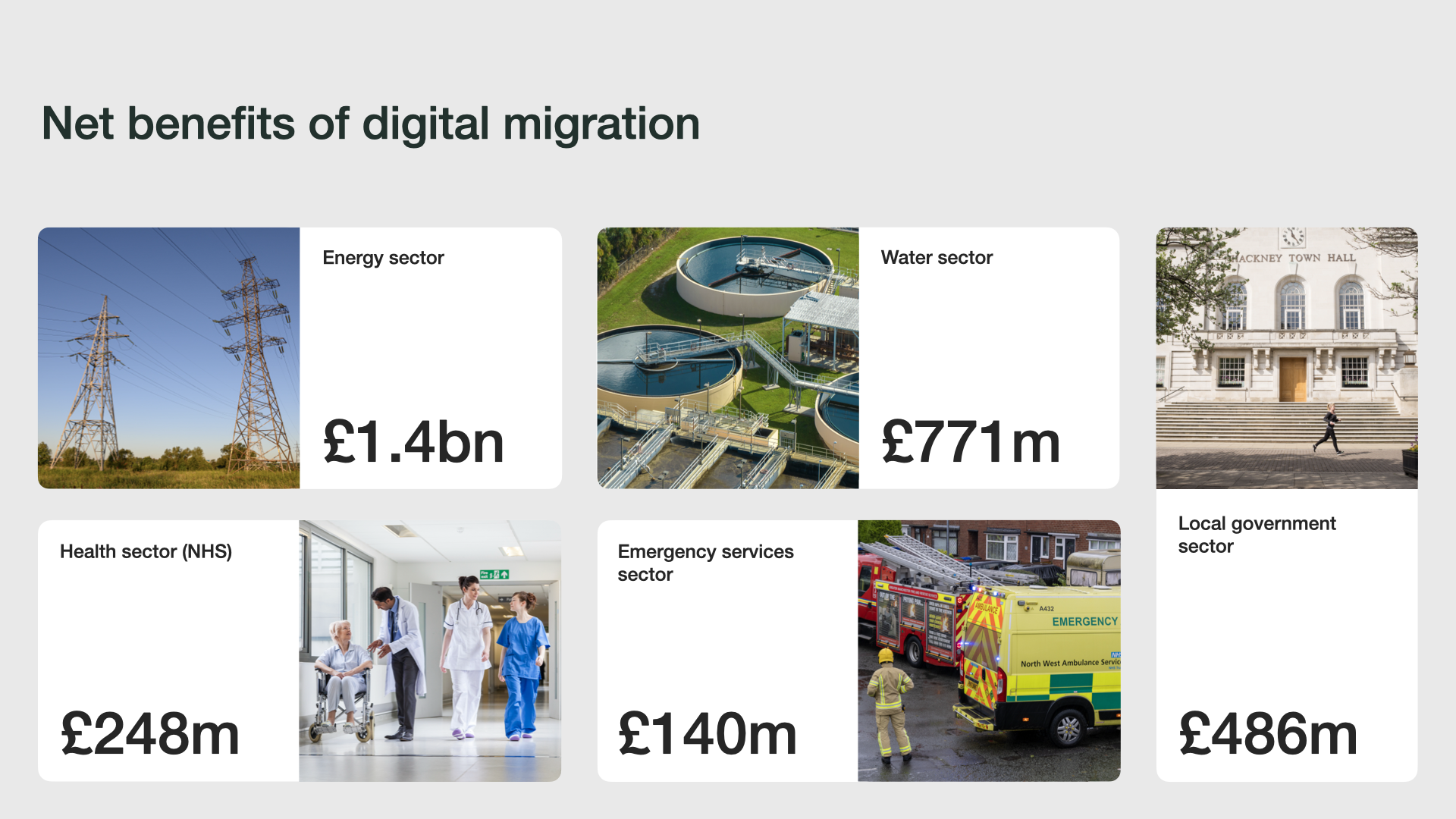

We were able to determine a series of net economic benefits of fixed and mobile migrations for the five sectors we studied which incorporated an honest accounting of the costs faced by firms making the switch.

What did we do?

To understand the progress to date in migrating away from the PSTN, 2G and 3G networks and evaluate the economic impact of adopting newer technologies, we:

Identified and benchmarked the range of remaining legacy devices still in use in the CNI sectors, from phone lines and telecare systems to lift lines and sewage overflow monitors;

Estimated the likely cost of replacing these devices, considering possible savings from simplifying infrastructure;

Projected how the resilience of these legacy networks will continue to degrade and calculated the cost of inaction for firms that delay migration and experience longer and more frequent losses of service; and

Developed a series of economic models to predict the possible efficiencies of adopting digital connectivity, from reducing the electricity consumption of the water sector to cutting down on the number of false fire alarms each year.

Find out more

We have developed a trusted methodology for economic impact assessment. The findings of our work are frequently quoted in public and political forums and in the international press and media.

Speak to us to find out more: info@assemblyresearch.co.uk